Automatic stabilizers have a great advantage. They are built into the budget program by setting the net tax rate, and work automatically. There is no need to determine if the shift in autonomous expenditure is transitory or persistent. By reducing the sensitivity of the economy to expenditure shocks, automatic stabilizers are always at work reducing the size of output and employment fluctuations.

Automatic stabilizers: tax and transfer programs that reduce the size of the multiplier and the effects of transitory fluctuations in autonomous expenditures on equilibrium GDP.

Income taxes and transfers, such as unemployment benefits, are important automatic stabilizers. At given net tax rates, a fall in national income, output, and employment raises payments of unemployment benefits and reduces tax collections. Both effects mean that disposable income changes by less than the change in national income. The slope of the aggregate expenditure function (c(1–t)–m) is lower, and so is the multiplier. Conversely, in a boom, net tax revenues rise and disposable income rises by less than the rise in national income, which helps dampen the boom. However, automatic stabilizers only serve to moderate the fluctuations in real GDP caused by fluctuations in autonomous expenditure. They do not offset those autonomous expenditure disturbances. There is no automatic change in autonomous government expenditure or tax rates. Those changes usually come from discretionary fiscal policy.

Governments use discretionary fiscal policies to offset persistent changes in autonomous expenditures. A persistent drop in investment or exports would be offset by an increase in government spending and by cutting taxes, or both as for example the Canadian government's Economic Action Plan in response to the recession of 2009. Alternatively an export or investment boom might be offset by higher tax rates or reduced government expenditures.

Discretionary fiscal policy: changes in net tax rates and government expenditure intended to offset persistent autonomous expenditure shocks and stabilize aggregate expenditure and output.

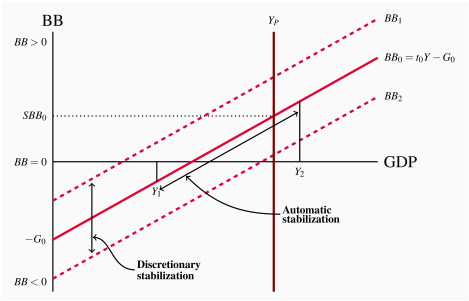

The budget function and the structural budget balance we discussed earlier provide a good illustration of automatic and discretionary fiscal policy. Figure 7.8 shows a government budget function BB0=t0Y–G0 and a structural budget balance SBB0 at potential output YP. This budget function represents a fiscal program designed by the Minister of Finance and approved by parliament.

Figure 7.8 Automatic and discretionary fiscal policies

Automatic stabilization comes from changes in the budget balance along the BB0 line as Y fluctuates between Y1 and Y2. Discretionary stabilization shifts the budget function as a result of changes in government expenditure or taxes.

Discretionary fiscal policy sets both the position and slope of the budget function. A change in discretionary policy would change the entire budget line. Figure 7.8 illustrates discretionary policy as shifting the BB line up to BB1, in the case of restraint or austerity, or down to BB2 to provide fiscal stimulus. Automatic stabilization is a part of all these programs. It comes from the slope of the budget function, the net tax rate t0 in this case. Any fluctuations in private sector autonomous expenditures cause changes in income Y. These changes in Y for example, down to Y1 or up to Y2, cause movements along the budget function and a change in the budget balance, as shown in Figure 7.8. The effect of the change in the budget balance is stabilizing. A larger net tax rate would mean larger automatic changes in the budget balance in response to changes in income and more automatic stabilization. When we use the budget function to show fiscal policy changes, we can also consider more complex programs that change both the slope of the function and the structural balance. It is quite easy to present fiscal policy in theory and illustrate it in diagrams but does it work in the real world? Why, if governments have fiscal tools to stabilize and offset fluctuations in aggregate expenditure and demand do we still experience business cycles, including the recession of 2009 and the prolonged recovery? The answer has several dimensions. While automatic stabilizers moderate the severity of fluctuations in autonomous expenditures they do not offset those fluctuations. That calls for discretionary fiscal policy, namely a change in the budget plan involving changes in autonomous government expenditures and net tax rates. The process is partly economic and partly political and can take time. The timelines involved are frequently defined in terms of recognition lags, decision lags, implementation lags and impact lags. It takes time to recognize a persistent shift in aggregate expenditure and identify its source. This involves the availability of economic data and economic analysis to establish the size and source of shift in economic conditions. That in turn provides the basis for the design of the new budget program required. The implementation of the new budget is a political process. It may involve substantial time and changes to the budget before it passes. Once the budget passes and new expenditure plans and tax rate are in effect it takes time for them to work through the economy and have their full impact on aggregate expenditure and national income. As a result, economic fluctuations are well underway before discretionary fiscal policies can shift to offset them. Discretionary policies may still provide stabilization but they do not completely eliminate business cycle fluctuations.

This page titled 7.5: Automatic and discretionary fiscal policy is shared under a CC BY-NC-SA license and was authored, remixed, and/or curated by Douglas Curtis and Ian Irvine (Lyryx) .